Brand Revitalization and Repositioning – part ii

Pumping energy for brands to continue the journey

Pumping energy for brands to continue the journey

Last week’s article highlighted the difference between repositioning and re-branding brands and its importance. Both global and local case studies were discussed covering the two concepts. This week’s article focuses more on brand rejuvenation and revitalization in the FMCG sector. As FMCG is a vast sector, which consists of F&B, Personal Care, Home Care, etc. few selected case studies would be picked from different sectors to elaborate on the need for brand rejuvenation and revitalization.

As a brand goes through its lifecycle passing the introduction growth- maturity stages, as it reached the decline or if the brand seems to be hitting a dead-end, and if the market is not stagnant and or growing, there has to be a mechanism to take immediate steps to keep the brand going on its journey for many more years to come without killing the brand. (As per the BCG matrix, when a brand reaches the end of its maturity, the brand should be killed and for the same reason, it’s known as killing the dog.

However, thank to brand marketers’ strategies, brands now don’t need to face this death even though the brand is reaching the end of its maturity instead, the brand can begin a new journey when it’s relaunched or revamped. In the literature on brand strategies, this is referred to as the “S” curve as it takes the shape of the letter S in the alphabet when the brand continues revamping exercises after given intervals.

The S curve Effect on Brand Lifecycle

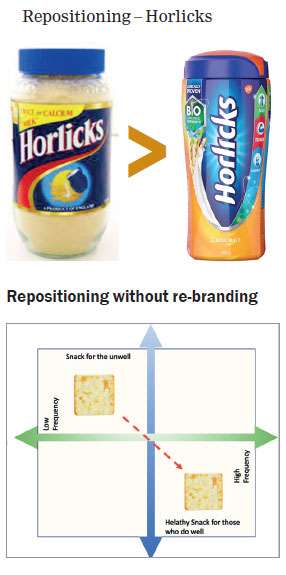

Brand re-branding coupled with brand repositioning can create a bigger impact in the market when the brand has become irrelevant to the market. One of the best examples to cite is; how Horlicks was positioned in the market as a malted drink for adults, and in the Sri Lankan context mostly for people who were unwell. The bottle looked bulky and bigger and it didn’t have a nice shape. The visual on the label also looks less colorful and there wasn’t any vibrance in the bottle. As it was reaching a natural death, the brand was repositioned for kids giving it a better shape, and vibrant colors supported with a campaign that featured kids. Suddenly the brand was awakened and the brand which looked only relevant to elderly people is now relevant to kids and young adults too. The Horlicks case study is a combination of both repositioning and re-branding coming hand-in-hand to find a better place in the market.

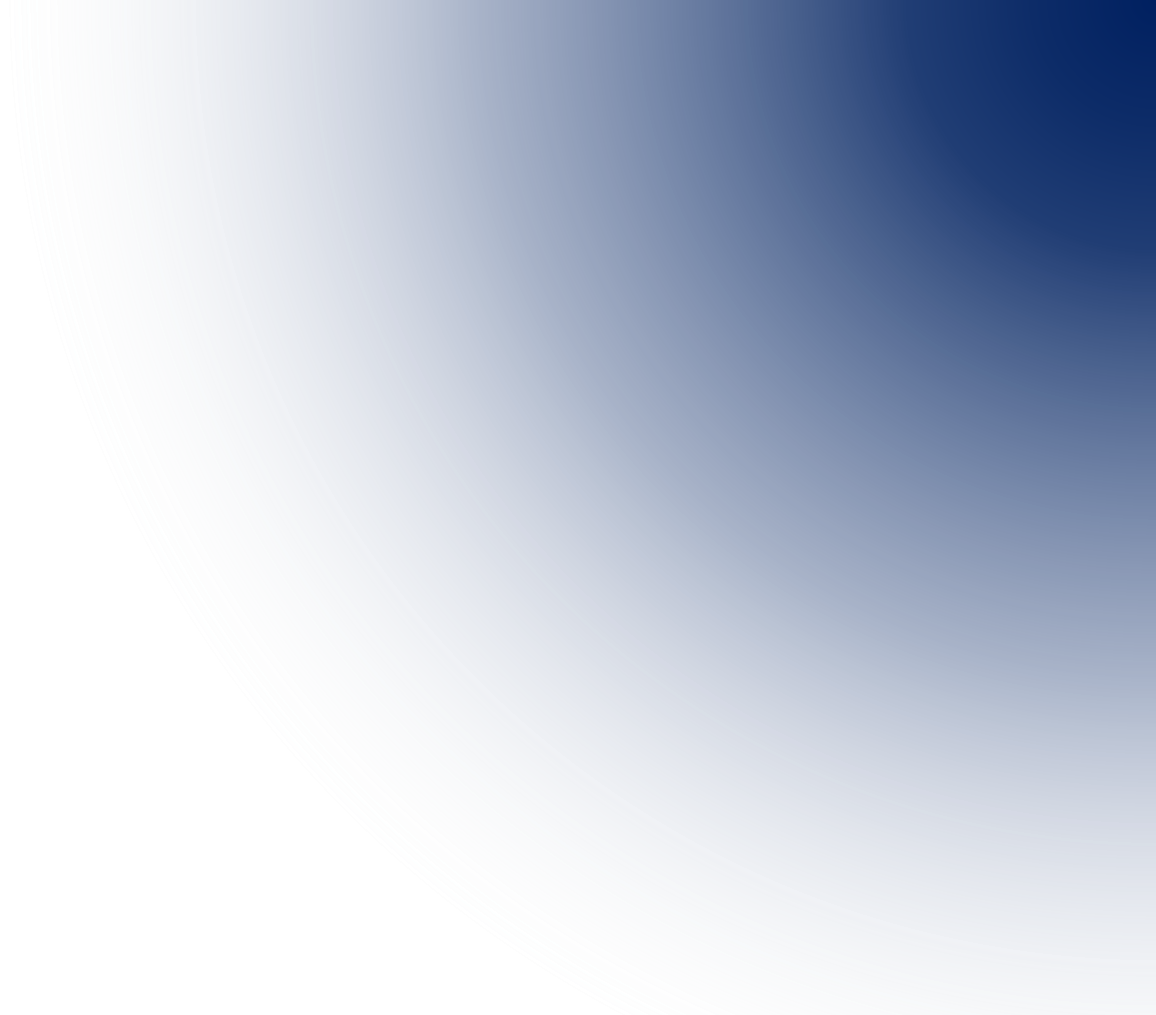

There are many local case studies where the brands have been repositioned without going through any rebranding. One of the classic examples of this is how Cream-Cracker was repositioned. Just like Horlicks, Cream-Cracker too was positioned for elderly people and mostly for sick/ unwell people to eat.

There was a time, Tony Ranasinghe and Airangani Serasinghe endorsed Creamcracker with “Lunu-Miris”. It was at this point, the cream cracker was re-positioned as a remedy for small hunger pans. Though it was Munchee of CBL who did the innovative re-positioning of the product, the overall category grew faster. Regardless of who did the work, both, Munchee and Maliban got the benefit of a smart idea. It’s probably one of the most successful re-branding exercises as there weren’t any drastic changes done in the product or packaging, instead purely shifting the minds of the consumers from one end to another.

Therefore, what one needs to understand is that repositioning is more about identifying the exact position that it should occupy in the minds of the people than re-packing and changing colors and names. Perceptual maps can add a lot of value to this exercise in identifying unoccupied areas to tap into. The same applied to many other local brands. One of the other successful applications is; how Sunquick repositioned itself from a domestically consumed drink to a gift. The campaign which ran on the idea of gifting a bottle of Sunquick changed the dynamics of the market.

The same applied by Nestomalt just like how Horlicks did it. Re-branding without re-positioning. There are instances where rebranding has taken place without re-positioning. French Corner was re-branded as Nolimit but there was no repositioning that took place along with the exercise. It was still targeting the same customer segment that it was targeting before. Sri Lankan Air Lines did the same without any repositioning to pump energy to the brand when Emirates took over the operations in 1998. Elephant House did the same to make it look more current and novel when John Keells took over from the government.

People’s Bank, BO, NSB, Sri Lanka Insurance, and SLT all have done the same re-branding without any repositioning attempt. The main takeaway from today’s article is that the re-positioning has to happen in the minds of the consumer- not in the packs or the product. Therefore, as marketers identifying the exact position to occupy the brand is the key to success. Re-positioning or re-branding without strategic thinking will only cost money and there will be no results achieved. Next week’s article will look at more examples from the services sector.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)